History of Moonshine

The governmental taxing of whiskey and illegal distilling is not a new thing. The Whisky Rebellion of 1791 was a result of the Congress under President George Washington laying a tax on alcohol. Most of the distillers of the time were farmers who lived in remote areas where it was difficult to get their grain to market. Their excess grain was distilled. The “Whiskey Boys” of Pennsylvania, Virginia, North Carolina and South Carolina protested the tax, sometimes violently. Tennessee and Kentucky, not yet in existence, offered safe haven for distillers or they too would have been a part of the protests.

The violence turned to armed rebellion in 1794. One  tax collector had his head shaved, his horse stolen and was then tarred and feathered. Washington responded with a sizable militia ordered into the countryside to arrest and detain the rabble. The suppression of the rebellion proved unpopular and became a detriment to the Federalist Party. The whisky tax was repealed in 1803.

tax collector had his head shaved, his horse stolen and was then tarred and feathered. Washington responded with a sizable militia ordered into the countryside to arrest and detain the rabble. The suppression of the rebellion proved unpopular and became a detriment to the Federalist Party. The whisky tax was repealed in 1803.

The Civil War found a new whisky tax instituted to fund the Federal Government. The extremely high taxes were as much as eight times the cost of the liquor itself. Small distillers began hiding in the backwoods in order to avoid the taxes. The Revenue Bureau of the Treasury Department transformed their “collectors” into a policing authority. The Moonshiners and Revenuers were born.

From these early days of resistance to taxes we move into the early 1900s when the sale of alcohol was actually made illegal in many places. In an odd incongruity, the production of moonshine actually increased as more local municipalities heeded the outcries of the prohibition and temperance movements to make the sale of alcohol a crime. Prohibition also lowered the standards of quality as producers concentrated on making larger amounts to meet the increased demand. This substandard shine was termed “Mean Whisky” and could result in serious injury or even death. One medical problem, known as Jake Leg Syndrome, caused partial paralysis of the feet and legs after consuming a drink called Jake. Because of the underground nature of the business, health concerns were often ignored. Contaminants, bacteria, and poisonous additives sometimes created a potential danger to the consumer.

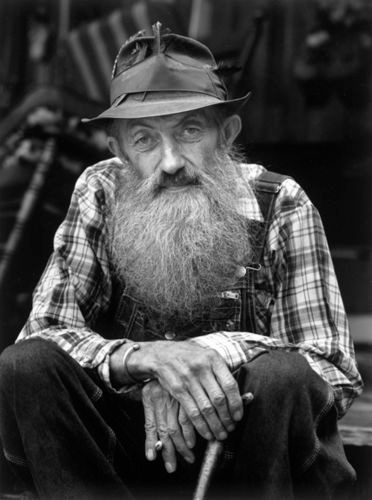

Popcorn Sutton

Another moonshiner hailed as a hero in Maggie Valley was recently in the news again. Marvin  “Popcorn” Sutton, age 61, committed suicide on March 16, 2009 rather than serve time in a Federal Prison for yet another arrest. Popcorn, who at the time of his demise lived near Parrotsville, Tennessee in the Appalachian Mountains, came from a long line of moonshiners in western North Carolina. According to him, “the heyday of moonshining was from 1965 to 1972 when you could buy likker about every 200 feet in places.”

“Popcorn” Sutton, age 61, committed suicide on March 16, 2009 rather than serve time in a Federal Prison for yet another arrest. Popcorn, who at the time of his demise lived near Parrotsville, Tennessee in the Appalachian Mountains, came from a long line of moonshiners in western North Carolina. According to him, “the heyday of moonshining was from 1965 to 1972 when you could buy likker about every 200 feet in places.”

One of Popcorn’s last arrests was in 2007 when a fire broke out at his home in Parrotsville and his stills were discovered. He was fined and sentenced to two years probation. He was arrested again in 2008 and at trial his illegal activities all the way back into the 1970s was presented.

He was sentenced to serve time and would have likely spent only a year or so in prison. He stubbornly refused to accept such treatment and committed suicide. Today he is a local folk hero for his mountain ways, rugged individualism and likker making skills.

Moonshining Today

In the 1950s moonshining was quite prevalent in the south. In the decade of 1954 to 1964 more than 72,000 stills were destroyed by federal agents in North Carolina, South Carolina, Georgia, Tennessee, Alabama and Mississippi.

But likker makin’ still goes on. A “white liquor” distiller in Wilkesboro was arrested in October 2009 and 929 gallons of moonshine was confiscated. Two brothers were arrested in Whitakers, North Carolina with 460 quarts of shine in November 2009. And in December 2009 community activist Gewndolyn Brown-Johnson of Charlotte was arrested for selling moonshine out of her child day care center. The distiller, 82 year-old Ervin Preston Finger, was arrested with 80 gallons of the hooch. Brown-Johnson said she didn’t know what was in the bag that the agent paid $80 for.

Today you can legally buy a part of the past with a purchase of Catdaddy Carolina Moonshine. This triple-distilled flavor moonshine is made in Madison, North Carolina and is totally legal. In shine circles the term Catdaddy described “the best of the best”.

Laws Surrounding Making Moonshine

Real moonshine comes in two “flavors” – legal and illegal. The essential difference is one is taxed and one is not. It’s all about the taxes. You can go into most any liquor store and buy moonshine such as Georgia Moon Corn Whiskey, Platte Valley Corn Whiskey or Catdaddy. The federal tax on a gallon of whiskey is $15.50.

It is legal to own a still; you can buy one online for less than $800. But if you want to produce any alcohol in your still, even for your own personal consumption, you need a federal permit. Under the alternative fuels law, you can make up to 10,000 gallons a year of ethanol, which can power engines when mixed with gasoline.

“Yes, you can have a still, but it must be permitted and you can produce spirits for fuel use only,” said Art Resnick, director of public and media affairs for the Alcohol and Tobacco Tax and Trade Bureau of the U.S. Treasury Department. “Let’s make this perfectly clear: It’s illegal to make moonshine, which is untaxed spirits.”

Even if a person wanted to make moonshine at home and pay federal taxes, it’s not that simple. It requires a federal distiller’s license and is cost-prohibitive for anyone other than a business.

Because of the difficulties in legally distilling your own spirits, a popular new home brewing underground is developing. Artisans are now busy making small batches of “craft” moonshine. The main idea is to create good tasting hooch for personal consumption rather than to produce large amounts for sale. This is still illegal. Oddly, home brewers can legally make beer and wine for personal use, but distilling liquor on an unlicensed still is a felony punishable with a $10,000 fine and up to 5 years in a federal penitentiary.

Why the difference between beer/wine and liquor? Money …. tax money to be specific. A bottle of whiskey is taxed more than $2 while the same size bottle of wine is about 20 cents. Beer is 5 cents a can. It is possible to obtain a license after going through reams of paperwork and spending some $20,000, but that is hardly worth it for the backyard distiller.

Names For Moonshine:

Other names for moonshine include: Branch Water, White Lightning, Kickapoo, Moonshine, Happy Sally, Ruckus Juice, Joy Juice, Hooch, Panther’s Breath, Mountain Dew, Hillbilly Pop, Skull Cracker, Bush Wisky, Stump, Mule Kick, Catdaddy, Cool Water, Old Horsey, Rot Gut, Wildcat, Rise’n Shine and Splo.